TRAXIA - Trade Finance Solutions With A Blockchain System

On any given day around the world, the square measure around $43 trillion of assets or accounts owed on the books of companies, of which, banks solely finance around $3 trillion of the total (Kemper, 2016). On a more granular level, there is a gap in global trade finance of around $1.6 trillion, most arising from Asian companies (Asian Development Bank, 2016). The International Chamber of Commerce refers to trade financing as the‘oil’ in the engine of international commerce and highlights the unmet demand for such financing (International Chamber of Commerce, 2017).

Financial Technology (FinTech) companies have return up with solutions to the present gap in world trade finance. However, in the absence of new instruments and marketplaces that connect and bring together different trade actors new ventures have been unable to make a major difference, yet.

Financial Technology (FinTech) companies have return up with solutions to the present gap in world trade finance. However, in the absence of new instruments and marketplaces that connect and bring together different trade actors new ventures have been unable to make a major difference, yet.

What Is Traxia?

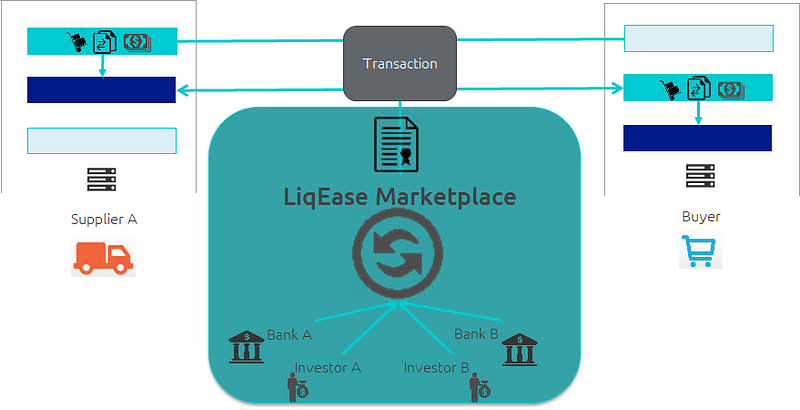

The Traxia is a decentralized liquidity network utilizing smart and blockchain contracts to increase trust, transparency and ultimately liquidity in B2B trading. Traxia intends to build Cardano blockchain and became the first project to migrate from Ethereum to Cardano. Cardano based project that will disrupt trade finance. Traxia allows normal midsize enterprises to trade accounts receivable, at a premium, to receive instant liquidity.

The Problem

Here are some problem that should be solved by TRAXIA, as follows:

- $43 trillion USD in accounts receivable on any given day.

- Banks continue to argue liquidity problems to not finance SMEs.

- Trade Finance operations are expensive, bureaucratic and time-consuming.

The Solution

Here are some solution from TRAXIA, as follows:

- Trust and Transparency - an inherent feature of blockchain technology, further enhanced with smart contracts.

- Securitization and Standardization – theTraxia focus with LiqEase on developing the use case.

- Access to capital markets through decentralization.

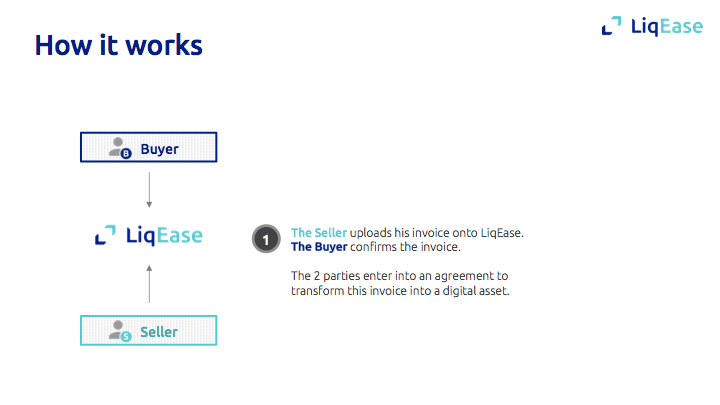

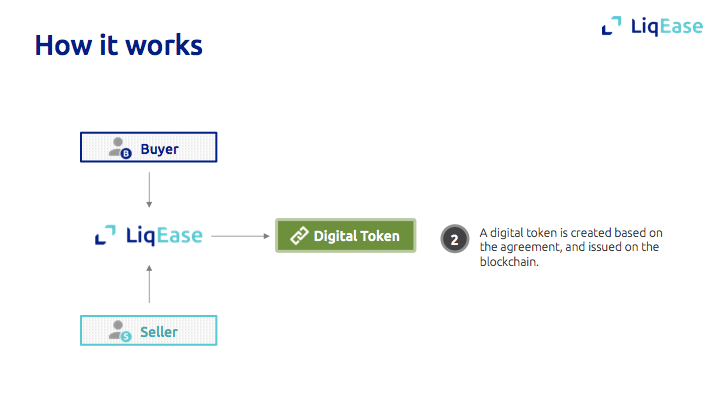

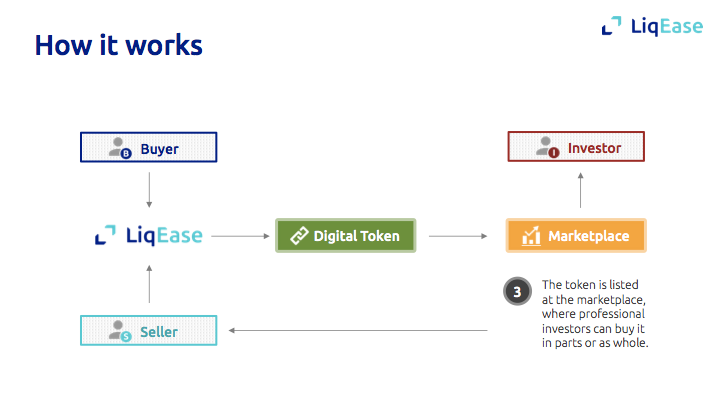

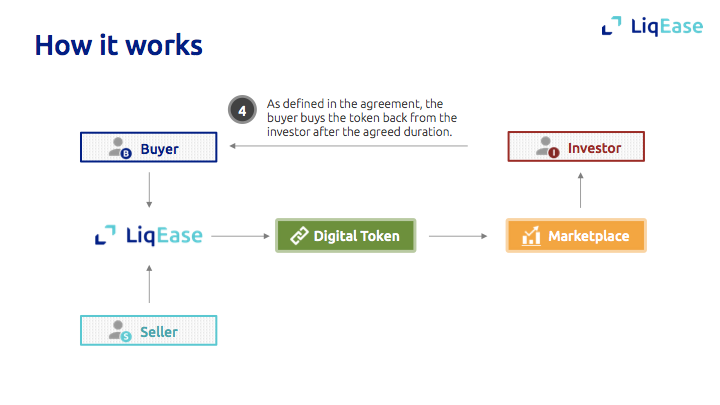

How Traxia Works

Based on illustrated above, the real world transaction asset is instantly digitized and the functional token and smart contract are listed on the marketplace. then the plus listed on the marketplace and distribution also as storing is happening during a suburbanized fashion in varied instances a default characteristic of a blockchain based asset as defined herein.

What Is Trade Finance?

Global and native banks support international trade through a large vary of product that facilitate their customers manage their international payments and associated risks, and supply required assets. The term “trade finance” is usually reserved for bank product that area unit specifically connected to underlying international trade transactions (exports or imports). As such, a assets loan not specifically tied to trade is usually not enclosed during this definition. Trade finance merchandise usually carries short maturities that mirror the standard shipping times and payment terms of thirty, sixty or ninety days or additional. (Bank for International Settlement, 2014).

Cardano Technology

Here within technology from Cardano, as follows:

- Among the first implementations of Cardano technology.

- Cardano invested within Traxia’s system through its investment arm Emurgo.

- Cardano’s superior technology can permit Traxia to gift a a lot of strong answer to raised tackle quantifiability, settlement, and security.

TRAXIA Membership Token (TMT) Sale

The supply of TMT is restricted to a maximum of max one billion (1,000,000,000) tokens in total, as well as those on the market purchasable throughout the Token Sale. The tokens are going to be generated upon the token launch and can be distributed within the following manner.- 70% of the tokens are eventually allotted amongst the community Distributed within the following order half-hour five-hitter five-hitter.

- 20% are going to be allotted to the muse creation, development team, early backers.

- 10% are going to be allotted to the treasury with the aim of providing TMT Liquidity if necessary in addition to being a contingency fund.

For more information about TRAXIA, please visit the link below:

- Website: http://traxia.co

- Whitepaper: https://goo.gl/8afHXv

- Token sale: https://www.traxia.co/token-sale-info

- Facebook: https://www.facebook.com/TraxiaFoundation

- Twitter: https://twitter.com/TraxiaNetwork

- ANN Thread: https://bitcointalk.org/index.php?topic=3019695.new#new

- Bounty Thread: https://bitcointalk.org/index.php?topic=3021679.0

Created By: INAQAMAQQU

Bitcointalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=1113323

Telegram: @inakamakku

ETH Address: 0xb01ED849a9f602cb01b62A5072d79182bc230f20

Komentar

Posting Komentar